Let’s talk about meal planning for a minute, shall we? I know, I know, super adulty, blah blah blah. Imma talk about it anyway because figuring out a system that works has been REVOLUTIONARY for my health, my wallet, my evening time management, and my sanity/anxiety about all three of those things.

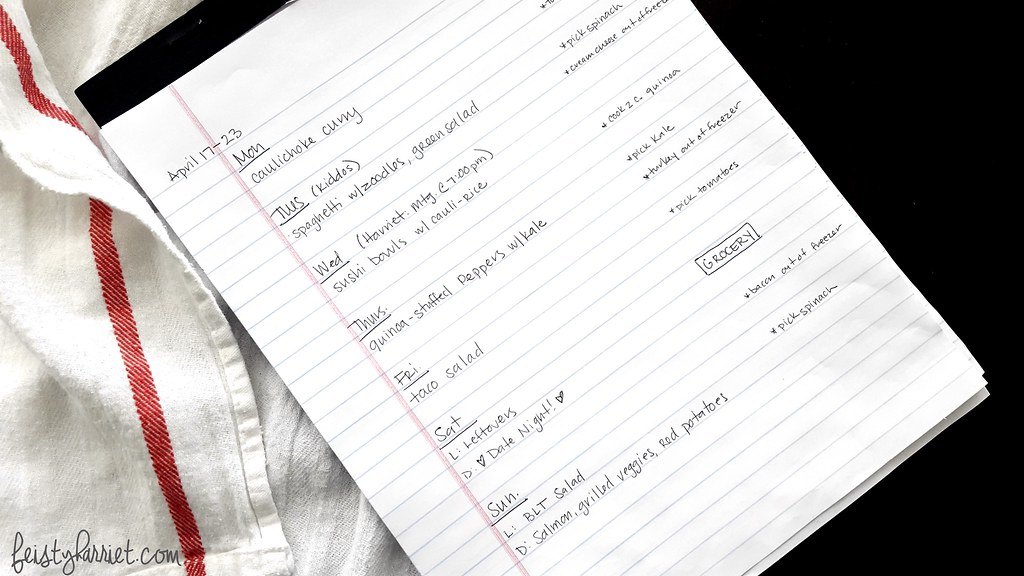

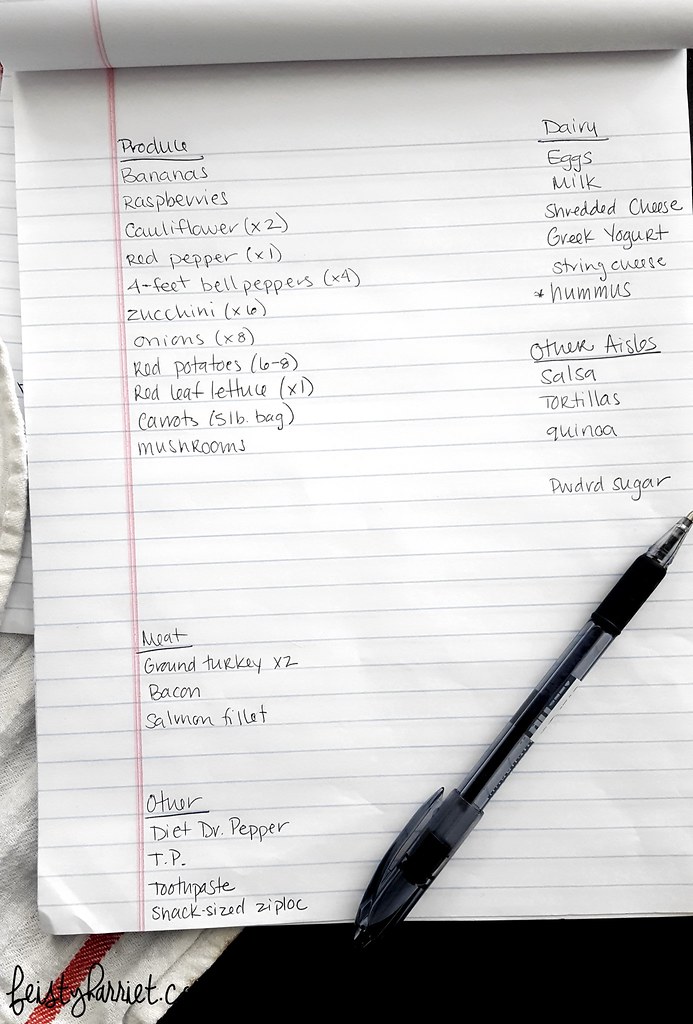

Once a week I make a meal plan and corresponding grocery list and then 100% stick to both. My super fancy format? I have a legal pad that is stuck to the side of the fridge with a couple of heavy duty magnets. I tried keeping notes on my phone/Google drive in various methods, but ultimately a legal pad with an attached pen has worked the best for me.The top page of my legal pad is a fairly detailed list of what is happening for meal time at my house for the next week. The second page of my meal planning notepad is always a running grocery list, so when I run out of sour cream or am getting low on quinoa or toilet paper I write it down and then pick it up on my next trip. When it’s time to go to the grocery store I have a list started and I never run out of toilet paper. Win-win. The third page is probably my best secret, honestly. It’s another meal plan for another week, Monday thru Sunday, which I fill out as I get inspired or as I have leftovers I know I need to use up, adding ingredients to the grocery list as I go.

Easy peasy. Well, kind of. It took me months to figure out my system and then train myself to stick to it. Lucky you, I’ve typed it all out here. I know. You didn’t realize Thursday could be so good, did you.

The first time you do this you’ll want to make a meal plan and grocery list at the same time so you know that you’ll have everything you need for dinner (and/or lunch and breakfast). On each week’s meal plan I make notes about what days we have Blue Eyes’ kids, and any commitments that may alter dinner plans. I also block out date night, and write down any work responsibilities or meetings that will preclude the need for leftover lunches. I also make little notes of day-before tasks like thawing meat or prepping something in advance; for example, if we are having taco salad on Tuesday there is a note on Monday to take the ground turkey out of the freezer to thaw overnight. When I get home from work and it’s time to make dinner I always know what I am making, I know the meat is ready to go, and I know that all the other ingredients are in the fridge/pantry. You’ve written out a meal plan and your grocery list, you take the list to the store and stick the meal plan to the fridge.

Viola! Adulty meal plan complete!

As the week goes on you start working on next week’s grocery list on page two; you are almost out of cumin, the bottle of salsa is running low, and the string cheese has been inhaled or abducted by mysterious fridge elves. You also decide you really want steak and asparagus next week, or you want to use up that ziploc in the freezer full of pesto you made last summer, or you are craving breakfast for dinner because omelets on Friday night is always a good idea. Write down these ideas as you get them throughout the week and page three starts shaping up nicely. The week goes on, your grocery list and next week’s meal plan are fleshed out. At the end of the week take a few minutes to finalize everything; rip off the first page (last week’s now complete plan) of your notepad, finish filling in next week’s meal plan and your grocery list, rip out the grocery list page and head to the store. And now, your new top page is your current meal plan and you can start all over again with grocery lists (page two) and next week’s plan (page three).

Taaa-daaah! You did it! Not so hard, right!? The peace of mind that comes from knowing exactly what I need to do when I get home from work in order to get dinner on the table is glorious. Knowing I have everything I need to make that has been a game changer. And being able to plan out in advance for healthy meals made at home has really helped keep my grocery spending in check (another post for another day) and stick to my health goals (more veggies, less sugar, plenty of cheese).

P.S. I keep a list on the very last page of my legal pad with a bunch of our favorite meals that I can make without even thinking about it, so if I am struggling to finalize a meal plan I just flip to the back page and pick one or two of those to fill in any remaining gaps so I can finish my grocery list and just go to the store already.

P.P.S. A note on grocery lists: I write mine in the order I go through the grocery store; all the produce is together, all the meat is together, so are all non-food necessities like shampoo and soap and ziploc bags. When I go to the grocery I always follow the same route which conveniently mirrors my grocery list.